crypto tax calculator australia

The Australian Tax Office classifies cryptocurrency as a property or a capital gains tax asset. Call 07 3088 9146.

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

CryptoTaxCalculator The most accurate crypto tax software solution for both investors and accountants.

. TokenTax works as a cryptocurrency tax calculator that connects to every crypto exchange. Simply copy the numbers into your annual tax return. Australian taxpayers get a little breathing space with a number of tax-free thresholds and allowances that happily apply to cryptocurrency tax too.

Online Crypto Tax Calculator with support for over 400 integrations. These digital providers have a tax report feature to export your transactions. Cryptocurrency generally operates independently of a central bank central authority or government.

There are some crypto exchanges in Australia that provide a free tax calculator such as Swyftx and Independent Reserve that you can also consider. As with most other countries Australians calculate their taxes owed based on the fiat value of the crypto at the time of the transaction. Tax treatment of cryptocurrencies.

As Tim Brunette co-founder of Crypto Tax Calculator an Australian startup that has leapt up in the crypto-adjacent space recently told DMARGE crypto is. You simply review your crypto transactions that you wish to export from your current exchange eg BTC Markets and export this data as a CSV file which is then saved to your device. The annual subscription covers all previous tax years.

As regulations are constantly changing we encourage you to visit the ATOs guide to cryptocurrencies for more information. Send the report to your accountant to complete your taxes. Therefore our crypto tax application does not store or keep your crypto data.

How Much Tax Do I Pay On Crypto In Australia. The Australian Tax Office has sent out letters to thousands of crypto traders in the last few months. The basis and price must then be subtracted from any fees your customers have paid to view the item.

Sam Bankman-Fried CEO of FTX said the world is very much looking for a crypto hub in APAC adding that other locations havent played out. Direct support for over 400 exchanges wallets DEXs and DeFi protocols. CryptoTraderTax is the easiest and most intuitive crypto tax calculating software.

Check out our free and comprehensive guide to crypto taxes in Australia. Just in time for tax season in the United States Australian startup CryptoTaxCalculator CTC announced it has raised seed capital to expand its automated crypto tax reporting tool further into. It provides users with an extremely user-friendly app which can be connected to all of their exchange platform accounts to seamlessly pull all the necessary transaction history data needed to get an accurate overview of the users tax slots.

To use a crypto tax calculator you should understand the basics of how crypto tax is. Start filing your crypto taxes today. Fill in the necessary information on your tax return and submit it yourself.

The term cryptocurrency is generally used to describe a digital asset in which encryption techniques are used to regulate the generation of additional units and verify transactions on a blockchain. Create a report on crypto activity using a crypto tax calculator like Crypto Tax Calculator Australia. It flawlessly tracks all of your wallet transactions like capital gains capital losses and exchanges.

Powerful Accurate Tax Reports. You will only start to pay Income Tax when your hit 18200 in total income per year. Crypto Tax Calculator Australia Use the free crypto tax calculator below to estimate how much CGT you may need to pay on your crypto asset sale.

Koinly is the only cryptocurrency tax calculator that is fully compliant with ATOs crypto tax guidance Capital gains report Miningstaking Income report Free tax preview Start for free See our 500reviews on Did you receive a letter from the ATO. Create a report of your crypto activity using a tax calculator like ours. Crypto tax breaks.

It allows you to keep track of all your transactions for free and generate as many reports as you need with our yearly licenses. 49 for all financial years. It serves as a one-stop shop to handle cryptocurrency tax reporting for all types of cryptocurrency use cases whether you are mining staking lending or simply buying or trading CryptoTraderTax will automate your tax reporting.

You can cancel your subscription with Crypto Tax Calculator Australia at any time and it also has a 30-day money-back guarantee. Its very accurate and simple to use. Crypto Tax Calculator Estimate Your Australian Tax - Fullstack Fullstack Provides The Best Crypto Tax Calculator in Australia With Over 20 Years of Experience.

At Crypto Tax Calculator Australia we support and strongly believe in customer privacy. By multiply your sale price by the total amount of the coin you sold you can obtain value. Our platform performs tax calculations with a high degree of accuracy.

If you sell or swap your cryptocurrency and make a profit you may need to pay tax on that profit as crypto profits are subject to capital gains tax CGT in Australia unless you are a professional trader. Crypto Trader Tax is one of the most popular cryptocurrency tax calculator platforms on the web. There are no limitations on the data source and you can import data from anywhere.

Get started JOIN COINPANDA Sign up for free Calculate your taxes in under 20 minutes. At Crypto Tax Calculator Australia their state of the art application makes calculating cryptocurrency tax easy whether you are a beginner trader or a crypto trading master. Crypto tax guide Mining staking income Generate complete tax reports for mining staking airdrops forks and other forms of income.

Crypto by reading his price list. If you need to amend your tax returns from previous years you will be covered under the one plan. How Do I Calculate Crypto Taxes.

Regardless of your trading history the process does not change and is simple and easy to use so you can. If youre asking yourself how do I calculate crypto tax in Australia then look no further.

The Ultimate Australia Crypto Tax Guide 2022 Koinly

Crypto Tax In Australia The Definitive 2021 2022 Guide

Koinly Crypto Tax Calculator For Australia Nz

I Ve Tried Crypto Tax Software So You Don T Have To R Cryptocurrency

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

Pin By Frank Macci On Crypto N More In 2022 Filing Taxes Investment Advice Paying Taxes

Calculate Your Crypto Taxes With Ease Koinly

Crypto Staking Rewards Calculator The Hub Crypto And Bitcoin Tax Blog Accointing Com

Next Steps Australia Crypto Tax Report Cryptotrader Tax

Australia Poised For A Cashless World Coinpedia Australia World Graphing Calculator

Malta Based Stasis Launches New Euro Backed Stablecoin Bitcoin Bitcoin Price Euro

![]()

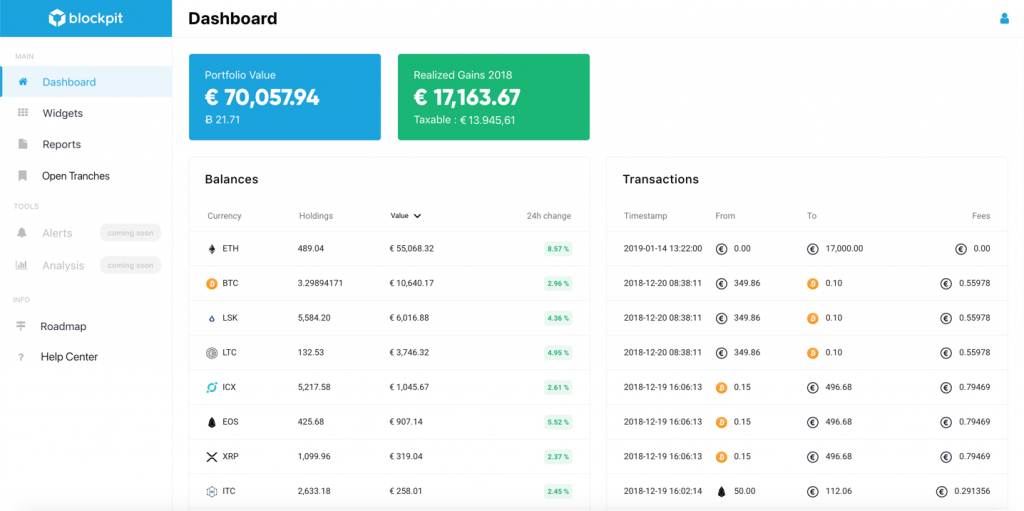

Cointracking Crypto Tax Calculator

How To Buy Cryptocurrency In Australia Buy Cryptocurrency Bitcoin Cryptocurrency

Crypto Tax In Australia The Definitive 2021 2022 Guide

![]()

Cointracking Crypto Tax Calculator

Australia Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda